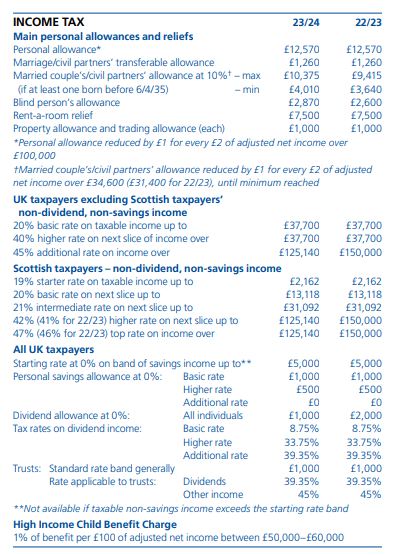

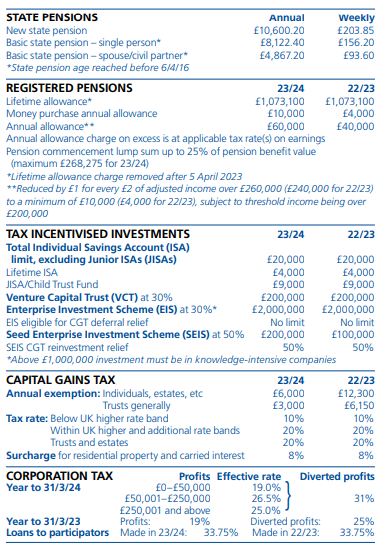

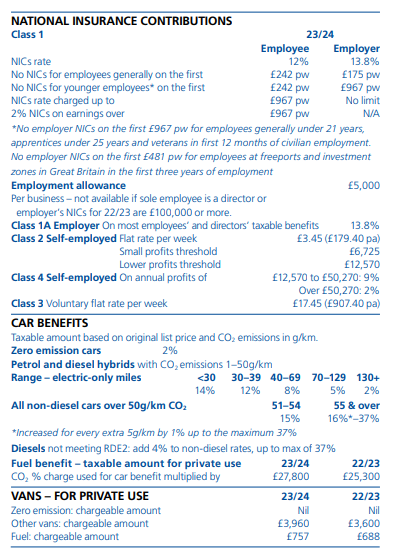

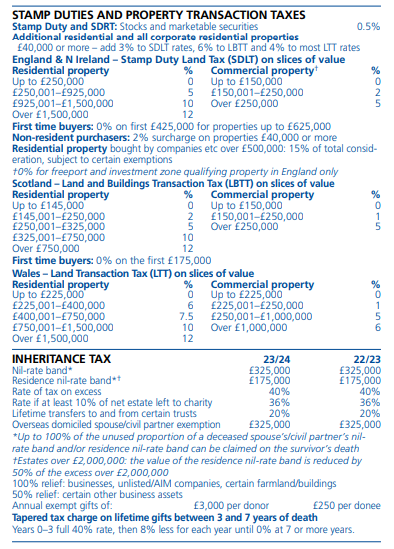

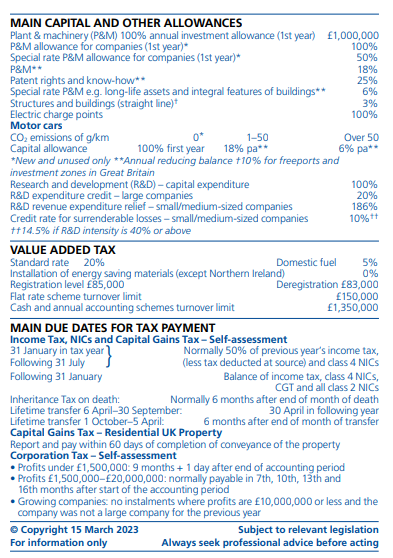

Current Tax Rates

We know all about taxes

Choose Bird Simpson & Co, Dundee for the latest information on the current tax rates and

tax advice.

Tax card

Call Bird Simpson & Co in Dundee on

01382 227 841 for current tax rates.

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

© 2024. The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.